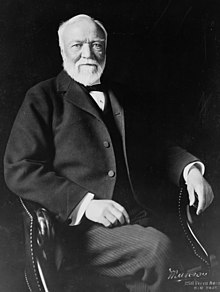

Andrew Carnegie

Investor, Industrialist, Railroad Baron and Philanthropist

Andrew Carnegie was a Scottish-American industrialist and philanthropist. Carnegie was born in Dunfermline, Scotland on November 25, 1835 and emigrated to Pittsburgh, United States with his parents in 1848 at age 12. Carnegie started work as a telegrapher, and by the 1860s had investments in railroads, railroad sleeping cars, bridges, and oil derricks. He accumulated further wealth as a bond salesman, raising money for American enterprise in Europe. He built Pittsburgh's Carnegie Steel Company, which he sold to J. P. Morgan in 1901 for $303,450,000 (equal to $9,883,973,400 today); it formed the basis of the U.S. Steel Corporation. After selling Carnegie Steel, he surpassed John D. Rockefeller as the richest American for the next several years.

Carnegie led the expansion of the American steel industry in the late 19th century and became one of the richest Americans in history. He became a leading philanthropist in the United States, Great Britain, and the British Empire. During the last 18 years of his life, he gave away around $350 million (roughly $5.5 billion in 2021), almost 90 percent of his fortune, to charities, foundations and universities. His 1889 article proclaiming "The Gospel of Wealth" called on the rich to use their wealth to improve society, expressed support for progressive taxation and an estate tax, and stimulated a wave of philanthropy.

Starting in 1853, when Carnegie was around 18 years old, Thomas A. Scott of the Pennsylvania Railroad Company employed him as a secretary/telegraph operator at a salary of $4.00 per week ($130 by 2022 inflation). Carnegie accepted the job with the railroad as he saw more prospects for career growth and experience there than with the telegraph company. At age 24, Scott asked Carnegie if he could handle being superintendent of the Western Division of the Pennsylvania Railroad. On December 1, 1859, Carnegie officially became superintendent of the Western Division. Carnegie then hired his sixteen-year-old brother, Tom, to be his personal secretary and telegraph operator. Not only did Carnegie hire his brother, but he also hired his cousin, Maria Hogan, who became the first female telegraph operator in the country.

Carnegie made his fortune in the steel industry, controlling the most extensive integrated iron and steel operations ever owned by an individual in the United States. One of his two great innovations was in the cheap and efficient mass production of steel by adopting and adapting the Bessemer process, which allowed the high carbon content of pig iron to be burnt away in a controlled and rapid way during steel production. Steel prices dropped as a result, and Bessemer steel was rapidly adopted for rails; however, it was not suitable for buildings and bridges.

By 1889, the U.S. output of steel exceeded that of the UK, and Carnegie owned a large part of it. Carnegie's empire grew to include the J. Edgar Thomson Steel Works in Braddock, (named for John Edgar Thomson, Carnegie's former boss and president of the Pennsylvania Railroad), Pittsburgh Bessemer Steel Works, the Lucy Furnaces, the Union Iron Mills, the Union Mill (Wilson, Walker & County), the Keystone Bridge Works, the Hartman Steel Works, the Frick Coke Company, and the Scotia ore mines. Carnegie combined his assets and those of his associates in 1892 with the launching of the Carnegie Steel Company.

Carnegie's success was also due to his convenient relationship with the railroad industries, which not only relied on steel for track, but were also making money from steel transport. The steel and railroad barons worked closely to negotiate prices instead of free-market competition determinations.

In 1901, Carnegie was 65 years of age and considering retirement. He reformed his enterprises into conventional joint stock corporations as preparation for this. John Pierpont Morgan was a banker and America's most important financial deal maker. He had observed how efficiently Carnegie produced profits. He envisioned an integrated steel industry that would cut costs, lower prices to consumers, produce in greater quantities and raise wages to workers. To this end, he needed to buy out Carnegie and several other major producers and integrate them into one company, thereby eliminating duplication and waste. He concluded negotiations on March 2, 1901, and formed the United States Steel Corporation. It was the first corporation in the world with a market capitalization of over $1 billion.

The buyout, secretly negotiated by Charles M. Schwab (no relation to Charles R. Schwab), was the largest such industrial takeover in United States history to date. The holdings were incorporated in the United States Steel Corporation, a trust organized by Morgan, and Carnegie retired from business. His steel enterprises were bought out for $303,450,000.

The buyout, secretly negotiated by Charles M. Schwab (no relation to Charles R. Schwab), was the largest such industrial takeover in United States history to date. The holdings were incorporated in the United States Steel Corporation, a trust organized by Morgan, and Carnegie retired from business. His steel enterprises were bought out for $303,450,000. Carnegie's share of this amounted to $225.64 million (in 2021, $7.35 billion), which was paid to Carnegie in the form of 5%, 50-year gold bonds.

Legacy

Carnegie devoted the remainder of his life to large-scale philanthropy, with special emphasis on building local libraries, world peace, education, and scientific research. He funded Carnegie Hall in New York City, the Peace Palace in the Netherlands, founded the Carnegie Corporation of New York, Carnegie Endowment for International Peace, Carnegie Institution for Science, Carnegie Trust for the Universities of Scotland, Carnegie Hero Fund, Carnegie Mellon University, and the Carnegie Museums of Pittsburgh, among others.